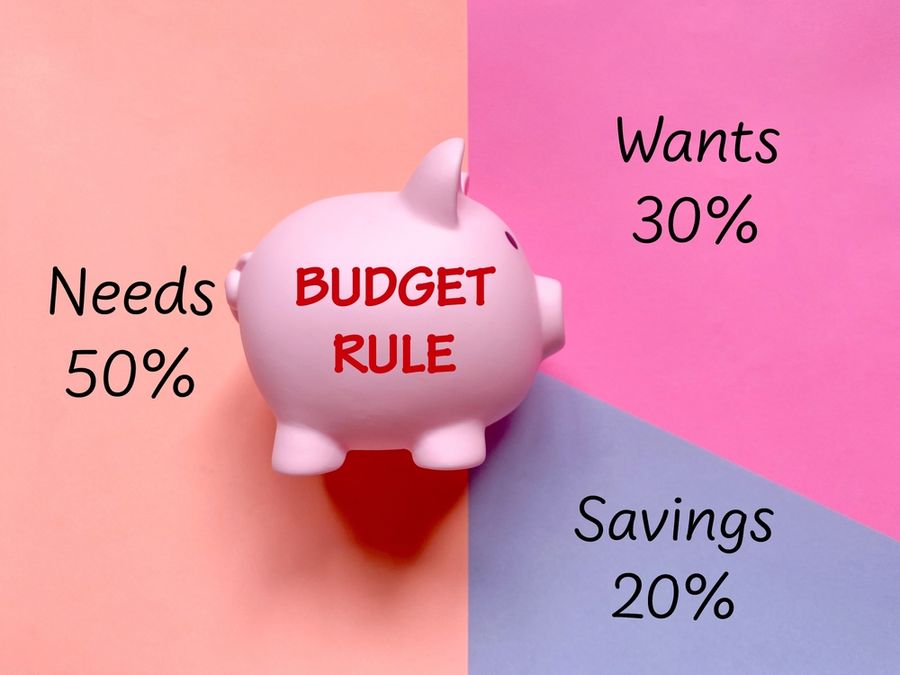

A simple budgeting framework can feel grounding in a world filled with financial decisions and shifting expenses. The 50/30/20 rule offers a balanced way to manage money without overwhelming calculations or strict limitations. Many people appreciate how naturally it fits into everyday life, allowing space for enjoyment while still supporting long-term goals. Its enduring appeal comes from a structure that adapts to different lifestyles, income levels, and priorities without creating unnecessary pressure.

Why the 50% Needs Category Brings Stability

Directing half of the monthly income toward essential expenses provides a sense of clarity and predictability. Housing, utilities, groceries, transportation, and required payments form the backbone of financial obligations. Keeping these costs within a defined percentage helps prevent overextension and reduces the stress that often comes from rising living expenses. A stable foundation allows other financial decisions to feel more manageable and less reactive.

When essential spending stays at a healthy level, long-term security becomes easier to maintain. A clear picture of fixed costs also creates space for informed adjustments whenever circumstances change. Maintaining balance in this category sets the tone for steadier financial routines and encourages thoughtful planning over time.

How the 30% Wants Category Supports Enjoyment

Allocating part of the income to enjoyable purchases helps prevent burnout and frustration. Dining out, entertainment, hobbies, and nonessential upgrades fall into this area. When people completely eliminate fun spending, budgets often become unsustainable, leading to impulsive decisions that undo progress. A dedicated wants category offers freedom without guilt and promotes a healthier relationship with money.

Having guidelines around discretionary spending also encourages more intentional choices. Instead of reacting to temptations, decisions feel more thoughtful and aligned with personal values. A realistic approach to enjoyment encourages long-term consistency and reduces the pressure that comes from overly restrictive plans.

Why the 20% Savings Category Strengthens Future Security

Setting aside a portion of income for savings, investments, or debt repayment builds a strong financial cushion. This category helps reduce the impact of unexpected expenses and prepares for future milestones. Whether the focus is on growing an emergency fund, paying down loans, or investing for retirement, consistent contributions create meaningful progress over time. The structure simplifies goal-setting by providing a clear starting point.

A steady savings routine also nurtures a sense of empowerment. Watching small amounts grow gradually reinforces positive habits and strengthens confidence in long-term planning. When savings become a regular part of the budget, financial growth feels more attainable and less intimidating.

Why Simplicity Keeps the Framework Relevant

The 50/30/20 rule continues to remain popular because of its simplicity. Many budgeting systems require meticulous tracking or complex spreadsheets, which can feel overwhelming. This straightforward breakdown reduces decision fatigue and helps people stay engaged without feeling burdened by details. Simplicity often leads to greater consistency and lowers the chances of giving up too soon.

Its adaptable nature also allows it to evolve with changing needs. Whether income increases, decreases, or becomes inconsistent, the structure provides a steady guide. A simple format makes it easier to recognize patterns, adjust spending habits, and stay grounded during financial shifts.

Flexibility for Different Income Levels

While percentages provide helpful guidance, not everyone’s financial situation fits neatly into a standard model. Higher-cost areas, unique obligations, or fluctuating income may require adjustments that better reflect personal realities. The flexibility of the 50/30/20 rule invites customization without sacrificing stability. People can shift percentages slightly while still maintaining the overall spirit of balanced financial management.

Flexibility encourages a sense of control rather than pressure. Adjusting categories to suit personal needs makes budgeting feel approachable and inclusive. This freedom supports long-term commitment and offers space for growth as circumstances evolve.

Why the Rule Still Resonates in a Modern Economy

Rising expenses, new forms of income, and shifting lifestyles have changed the way people interact with money. Even so, the fundamental goals of balance, clarity, and sustainability remain universal, which is why the 50/30/20 rule continues to resonate. Its structure addresses both present-day demands and long-term aspirations with a level of ease that fits modern routines. A dependable framework offers reassurance in a financial landscape that often feels unpredictable.

The rule also promotes thoughtful financial habits that align with current priorities. It supports mindful spending, encourages goal-setting, and helps create a financial pathway that feels both empowering and realistic. Its staying power reflects a timeless need for structure that adapts rather than restricts.

A Balanced Way Forward

A thoughtful approach to budgeting becomes much more manageable with a structure that feels supportive and adaptable. The 50/30/20 rule continues to endure because it respects both financial responsibilities and the desire for enjoyment along the way.

Its simplicity encourages long-term commitment and provides a framework that works with changing circumstances instead of against them. A balanced method offers clarity, confidence, and a smoother journey toward financial stability.