Envelope budgeting offers a hands-on approach that creates clarity around everyday spending. Many people enjoy the method because it brings structure, awareness, and a sense of control to financial decisions. Whether managed with paper envelopes or digital tools, the system highlights how money moves across categories throughout the month. A mindful approach can support intentional choices, reduce stress, and strengthen confidence for beginners wanting more visibility into their financial habits.

Understanding the Core Purpose of Envelope Budgeting

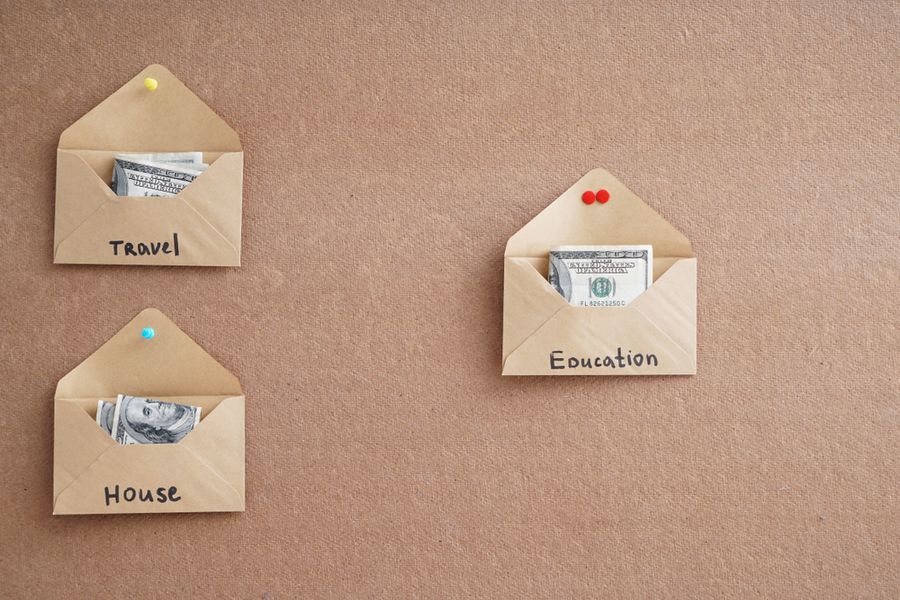

Envelope budgeting centers on dividing income into specific spending categories. Each category receives its own envelope filled with the allotted amount of money for the month. Once the envelope is empty, spending stops until the next planning period. This structure encourages awareness and prevents unplanned purchases from slipping through unnoticed. The physical or digital separation of funds creates a clear picture of priorities and spending routines.

Beginners often appreciate how intuitive the system feels. Having limits built into each envelope reduces decision fatigue and eliminates the guesswork that can come with flexible budgets. The method promotes discipline while allowing room for personal choice within each category. As awareness grows, the budget begins to reflect habits more accurately, and opportunities for small adjustments become easier to identify.

Choosing Between Paper and Digital Envelopes

Both paper envelopes and digital versions offer unique advantages. The paper provides a tactile experience that many people find grounding. Handling cash, labeling envelopes, and seeing the remaining balance visually can create a deeper connection to spending habits. It works especially well for those who prefer simplicity and enjoy physical organization.

Digital envelopes offer convenience and accessibility. Many apps allow for automated tracking, category adjustments, and real-time updates that simplify the process. They eliminate the need to carry cash and make it easier to manage multiple categories. Whether using paper or digital tools, the effectiveness comes from consistency and commitment to the system rather than the format itself.

Assigning Categories That Fit Your Lifestyle

Creating categories that reflect actual spending behavior is essential for a smooth experience. Common categories include groceries, transportation, entertainment, clothing, and personal care. More specific categories may be helpful for those with unique routines or recurring obligations. Tailoring envelopes to lifestyle needs ensures the system feels relevant and practical.

Reflecting on previous spending patterns can reveal which categories deserve attention. Some may require more flexibility, while others stay consistent month after month. Personalizing the envelopes helps maintain engagement and reduces the frustration that comes from unrealistic structures. A thoughtful category list supports better habits and encourages long-term use.

Adjusting Envelopes Throughout the Month

Envelope budgeting is designed to be flexible enough to accommodate unexpected expenses. If one category runs short, some people choose to transfer funds from another envelope to stay within overall limits. This approach maintains control while offering room to adapt. Others prefer stricter boundaries to strengthen discipline and reinforce long-term habits.

Regular check-ins help maintain awareness and prevent surprises. Reviewing envelopes weekly or biweekly ensures spending aligns with priorities and gives time to adjust before issues arise. Flexibility paired with structure creates a balanced method that adapts to real-life demands while still promoting intentional choices.

Incorporating Savings and Long-Term Goals

Envelope budgeting supports more than just daily spending. Many people create envelopes for savings goals, upcoming expenses, or annual payments. Setting aside small amounts each month makes larger obligations feel more manageable. Whether saving for a vacation, an emergency fund, or a holiday season, dedicated envelopes help build momentum toward long-term financial stability.

Seeing savings grow gradually encourages motivation and consistency. The method transforms future goals into approachable steps by breaking them into smaller contributions. Visual progress—whether through filled envelopes or growing digital balances—reinforces positive habits and helps maintain focus over time.

Staying Consistent With the System

Consistency is the backbone of envelope budgeting. Recording spending, updating balances, and reviewing envelopes regularly strengthens awareness and keeps the system functioning smoothly. While the process may feel unfamiliar at first, habits form quickly with repetition. A steady routine creates an environment where financial decisions feel more intuitive and less reactive.

Over time, the method becomes easier to maintain as spending patterns reveal themselves. Adjusting categories or allocations becomes a natural part of the monthly cycle. Consistency not only supports organization but also builds confidence, helping users feel more connected to their financial goals.

A Supportive Path Toward Financial Clarity

Envelope budgeting offers a straightforward way to understand spending while creating healthier financial routines. Separating money into intentional categories encourages reflection and helps reduce unnecessary expenses.

As envelopes become part of everyday planning, financial decisions start to feel more grounded and purposeful. With steady practice, the method brings clarity, stability, and a renewed sense of control over money management.